When it comes to making decisions about which user pain points to solve first, EdTech product leaders are caught between two opposing forces: increased investment scrutiny and faster release cycles driven by competitive pressures and AI.

Quantitative research increases statistical confidence more quickly

Our Problem-Solution Fit Packages use quantitative research to validate user pain points are significant enough to warrant solutions and that your proposed solutions solve those problems at scale.

Problem Validation Survey

Identify which problems have the highest impact to solve — before you invest resources in the wrong direction.

4 weeks | $8,000

Solution Validation Survey

Be sure your proposed design solutions will maximize ROI before you build.

4 weeks | $12,000

Ready to reduce risk with quantitative validation before you build?

Schedule a 30-minute discovery call to learn how the Problem-Solution Validation packages can help you validate which user pain points are significant enough to warrant solutions and that your proposed solutions address those problems at scale.

Stop risking costly miscalculations

Confirm you’ve identified the right problems and be sure your concepts will solve them.

✅ What You'll Learn From the Problem Validation Survey:

-

-

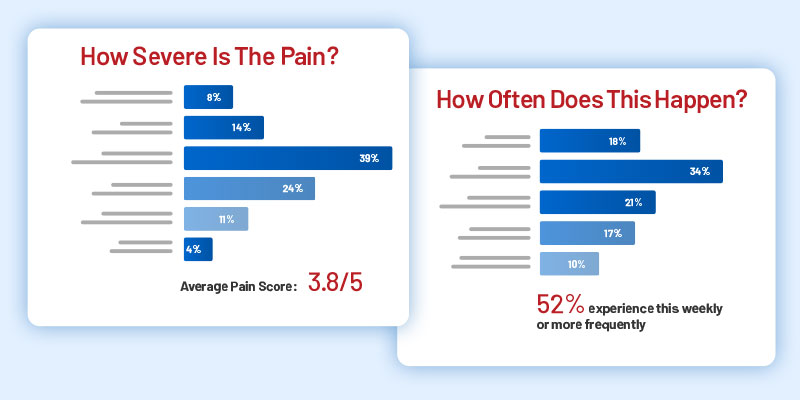

- Which problems cause the most pain and how often users encounter them

- Whether current workarounds are "good enough" to maintain the status quo or painful enough to drive solution adoption

- Where the opportunity is concentrated — by role, institution type, discipline, or context

- How large the opportunity is — with statistical confidence you can take to stakeholders

-

✅ What You'll Learn From the Solution Validation Survey:

-

-

- Which concepts resonate most strongly with your target users — and which fall flat

- How feature preferences vary by segment (so you can tailor offerings or tier strategically)

- What users are willing to trade off to get their most-wanted capabilities

- Price sensitivity signals that inform positioning and packaging decisions

- How your concepts differentiate from what users currently use

-

Want to see the packages in action?

Check out these walkthrough demos featuring sample data – great resources for imagining how your product data will be transformed into actionable recommendations.

Watch the Problem Validation Survey walkthrough video:

Watch the Solution Validation Survey walkthrough video:

Frequently Asked Questions

How are the Problem Validation Survey and Solution Validation Survey Packages different?

Both The Problem Validation and Solution Validation packages use quantitative research to increase confidence about critical product investments before you build.

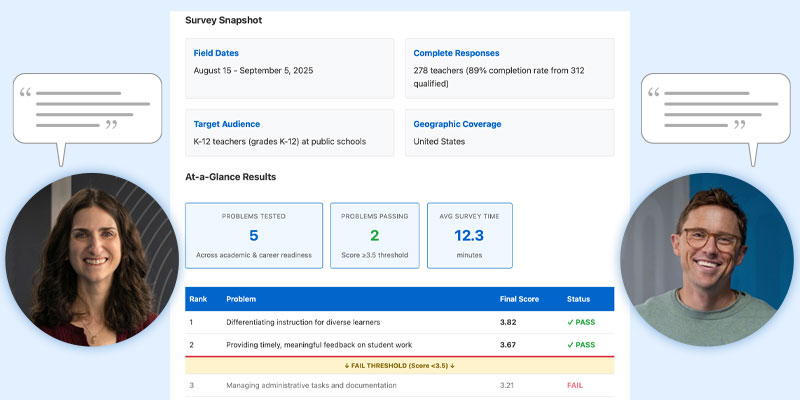

The Problem Validation Package is designed to help you pinpoint and prove which market pain points warrant solutions before you begin concepting and design. It identifies which problems cause the most pain and how often users encounter them, as well as, where and how large the opportunities are, resulting in an action plan with clear "solve this first" guidance and opportunity sizing.

The Solution Validation Package is designed to help you evaluate how well your proposed concepts and feature sets actually solve the pain points and help you capitalize on opportunities you have defined. It identifies which concepts resonate most strongly with your target users — and which fall flat. You'll also learn how your concepts differentiate from what users currently use, and price sensitivity signals that inform positioning and packaging decisions.

Do I need both packages?

The packages are designed to complement each other because they address different questions. But you don’t necessarily need to sign up for both.

If you already have proven that you are addressing the most impactful problems for your users at scale, then you can probably proceed directly to the Solution Validation Survey Package.

Is concepting and design included in the packages?

No — both packages are quantitative research only. If you need help with concepting and designing feature solutions, we are available to help with that. Read more about our design and prototyping services.

Is qualitative research included in the packages?

No — both of these packages are quantitative research only. If you need help with qualitative research, we are available to help with that. Read more about our research capabilities.

What happens week by week for each of the packages?

We know you can't wait six months for answers when your roadmap decisions are happening now. That's why each package is built for speed without sacrificing rigor.

Week 1 — Get Aligned on What Decisions You're Actually Making

We'll start with a kickoff to understand your situation—what you're trying to decide, who needs to be convinced, and what "good enough" evidence looks like for your context. Then we'll run a stakeholder workshop (usually 60 minutes) where we define decision criteria together.

This is where we get specific:

Problem Validation Survey: If 60% of users rate this problem as "severe," does that mean you build it? If Problem A affects 40% of users severely but Problem B affects 80% mildly, which takes priority? What frequency of occurrence makes a problem worth solving?

Getting clear on thresholds up front means the data actually drives decisions instead of just sparking more debate.

Solution Validation Survey: What adoption likelihood score justifies engineering investment? If Feature A has high appeal but low differentiation while Feature B is the opposite, which wins? When willingness to pay is strong for Feature C but only among 30% of users, does that justify the development cost? Getting clear on these thresholds means your survey results translate directly into roadmap priorities and pricing strategy.

For each package, we'll draft the survey approach and recruiting plan based on your user base and timeline.

Weeks 2–3 — Field the Survey and Analyze Results

For each package, we’ll handle survey programming, QA, and fielding—whether that's to your existing users or through a panel we recruit. While the survey is live, we're already building the analysis framework: segment cuts, confidence intervals, priority scoring.

Once responses are in, we run the statistical analysis and start translating numbers into narrative. We're not just calculating percentages — we're looking for patterns, inflection points, and segment differences that matter for your decisions.

Week 4 — Get Recommendations You Can Actually Use

We deliver a research findings report, executive deck, and 60-minute readout session where we present and discuss what the data means for your roadmap.

The results:

- Prioritized recommendations tied to your product decisions

- The data to back them up

- Documentation you can reference as you execute with your internal team or with support from ours.

Ready to Get Statistical Confidence in Four Weeks?

Schedule a 30-minute discovery call to learn how the Product-Solution Validation Packages can help you move more quickly with confidence.

Why do I need quantitative validation? (I already have plenty of qualitative data.)

EdTech teams make high-stakes bets every day: Which problem should we solve first? Which problem represents the greatest market opportunity? Should we enter this new market?

Qualitative research is essential for understanding why users struggle and what they need. But when you need to choose among several validated opportunities, size a market, or defend a prioritization decision to your board, you need a different kind of evidence.

Without quantitative validation, teams risk:

- Choosing based on short-term constraints or interpersonal politics rather than data at scale

- Entering markets blind to opportunity size or segment differences

- Struggling to build consensus when different leaders interpret qualitative findings differently

- Missing the forest for the trees by over-indexing on memorable anecdotes rather than representative patterns

- Building features that don’t drive revenue, but only demo well

- Wasting engineering resources without knowing if users show signals of willingness to pay

- Missing valuable segment-specific opportunities that only emerge when you analyze patterns at scale

The best product teams use both qualitative and quantitative research in sequence:

Qualitative research to deeply understand the problem space and generate solutions, then quantitative validation to prioritize and derisk before development. They answer different questions — and you need both answers to move forward confidently.

Who is the Problem Validation Survey right for?

✅ The Problem Validation Survey Package is the right fit if:

- You've identified multiple problem areas from qualitative research

- You need to choose among 2-5 competing product priorities

- You're entering a new market and need to understand opportunity size

- You need to understand which problems resonate across different segments (by role, institution type, etc.)

- You need statistical evidence to align stakeholders on which problem to invest in solving

❌ The Problem Validation Survey Package may not be the right fit if:

- You haven't conducted qualitative research yet (consider our UX Research services)

- You only have one problem to solve (you don't need prioritization)

- You need ongoing research support (consider our Research & Design Partner engagement)

Who is the Solution Validation Survey right for?

✅ The Solution Validation Survey Package is the right fit if:

- You've brainstormed multiple solutions to a validated, high impact problem

- You need to choose the strongest direction among 2-5 concepts or ideas

- You need to know which segments will actually pay for your solution

- You need to understand how feature preferences and willingness to pay vary by segment

- You need statistical evidence to determine if any concept is worth the investment to pursue

❌ The Solution Validation Survey Package may not be the right fit if:

- You haven't designed any concepts yet (consider our Rapid Prototyping Package)

- You only have one concept and don't need prioritization (simpler validation methods may work)

- You've already started building (consider our User Research & Testing services for usability testing, in-product feedback, qualitative interviews, or analytics analysis instead)

Can you also help me know what pricing is right for my market?

Yes we can! The Probem-Solution Validation packages are part of a complete market validation series that includes our Pricing Research Study.

Together, the three packages address critical go-to-market decisions that most EdTech teams struggle with:

- Problem Validation Survey Package — Identify which problems have the highest impact to solve at scale — before you invest resources in the wrong direction.

- Solution Validation Survey Package — Be sure your proposed design solutions will maximize ROI before you build.

- Pricing Research Study Package — Set the optimal price for the right buyers before you launch.

Get focused on the right problems and solutions for the right users.

Let's talk about how you can increase confidence with the statistical evidence you need to make data-driven roadmap decisions.

What makes Openfield a great choice to help you validate problems and solutions?

Founded in 2006, Openfield is a UX research and design partner focused solely on EdTech. Our work has helped product teams like yours make more confident roadmap decisions that result in greater user delight and reduced reworks.

Our research expertise has been honed through two decades of surveys, studies, and validation projects across every EdTech segment — from K-12 to higher ed, from corporate to institutional learning scenarios. We understand the unique complexities of educational technology: multiple stakeholder groups, institutional adoption patterns, compliance requirements, and academic calendars.

-

40,000+ hrsEdTech user research

-

130,000+ hrsOverall EdTech UX

-

2 million+Have used products we work on

-

Brian Keenan

As a Co-founder of Openfield, Brian’s focus is helping business leaders understand how UX research and design can help them increase speed to market, while reducing risk and waste. He is an avid student and practitioner of landscape photography, which pairs well with his love of road tripping and exploring vast and wild destinations.